Vodafone Idea shares rallied sharply by over 8%, reaching ₹8.30 intraday on September 15, 2025, following news that the Supreme Court has scheduled a tentative hearing on the telecom company’s plea regarding additional Adjusted Gross Revenue (AGR) dues for September 19, 2025. The stock has gained nearly 13% over the last five trading sessions and surged 26% so far this month, marking its highest level since April 2025.

VI AGR Dues Hearing Details

Vodafone Idea has challenged the Department of Telecom’s additional demand of ₹9,450 crore in AGR dues by filing a fresh writ petition in the Supreme Court. The company disputes the methodology behind the revised dues, especially amounts relating to pre-merger and post-merger periods, claiming duplication and seeking a comprehensive recalculation of dues dating back to before FY17. Despite government support measures in the past, including converting dues into equity, the firm continues to grapple with a total AGR dues burden estimated at over ₹83,000 crore. The hearing comes at a crucial time as Vodafone Idea seeks timely resolution and potential relief before dues payments escalate from March 2026.

Also Read: Texmaco Rail Stock Jump 3% After Getting ₹129 Crore Rail Electrification Project Order

Vodafone Idea Q1 FY26 Results

Vodafone Idea’s latest quarterly results for Q1 FY26 reveal a net loss of ₹6,608 crore, a slight increase from the previous year’s ₹6,432 crore but an improvement from the preceding quarter’s ₹7,166 crore loss. Revenue from operations climbed 5% year-on-year to ₹11,008 crore. The company’s Average Revenue Per User (ARPU) rose to ₹177 per month from ₹154 a year ago, signaling better monetization of its subscriber base. The 4G/5G subscriber count expanded to 127.4 million. Vodaforn Idea underpinning a gradual recovery in operations.

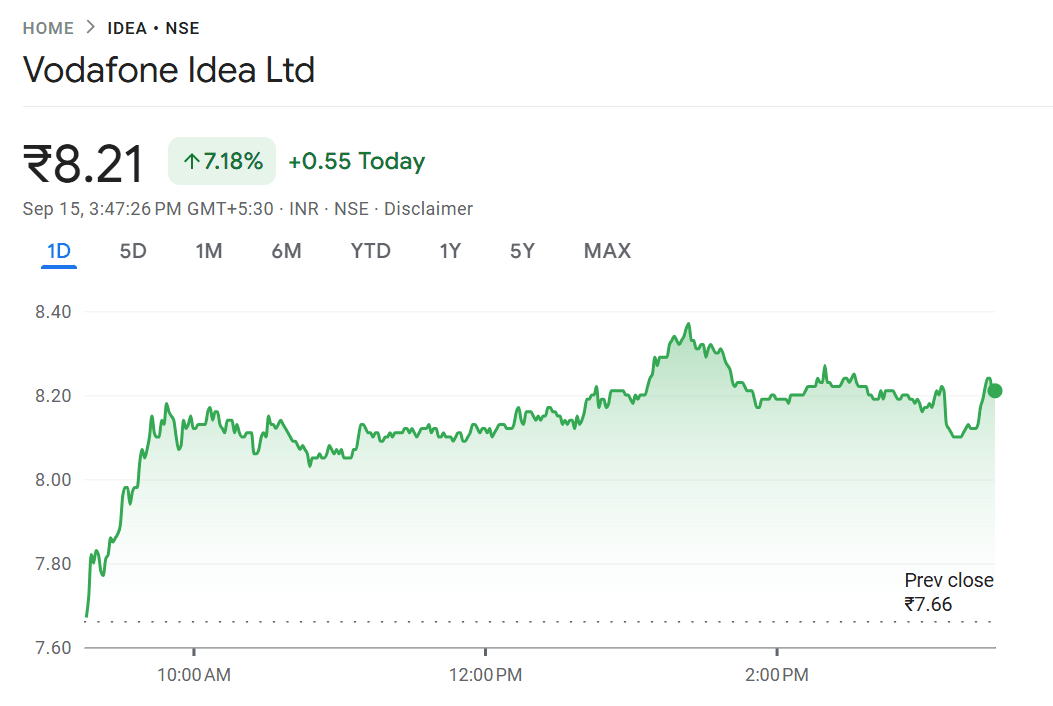

Vodafone Idea Latest Share Price Today

On September 15, 2025, Vodafone Idea shares surged over 8%, reaching an intraday high of ₹8.32, driven by the upcoming Supreme Court hearing on the AGR dues case scheduled for September 19. The stock has recorded a strong rally this month, gaining nearly 26%, and is trading above its key moving averages, signaling a positive trend despite ongoing challenges. Over the past three months, Vi shares have risen by approximately 22%, although the one-year trend remains negative due to persistent financial pressures.

Currently, Vodafone Idea trades in a 52-week range of ₹6.12 to ₹13.77 with a market capitalization of about ₹83,000 crore, reflecting continued investor interest fueled by hopes of regulatory relief and strategic funding.

Also Read: Yes Bank Share Price Target 2025, 2030, 2035, 2040, 2045 and 2050

Future Outlook

Market optimism around Vodafone Idea is buoyed by the upcoming Supreme Court hearing and ongoing talks of fresh funding. The government reportedly is looking for a strategic investor willing to inject around $1 billion (₹8,800 crore) for a minority stake, while promoters Aditya Birla Group and Vodafone are prepared to dilute their holdings. The stock’s uptrend reflects investor hope for a favorable resolution allowing the company to stabilize its finances and invest further in network expansion, especially in 5G services rolled out across multiple cities.

Vodafone Idea continues to face significant financial and operational challenges but the pending AGR dues hearing combined with gradual improvement in financial metrics and potential fresh capital infusion provides a cautiously optimistic outlook for the telecom firm in the competitive Indian market.

This article will be updated with any new developments post the Supreme Court Vodafone Idea hearing on September 19, 2025.

Also Read: 250% Surge in 6 Months! Small-Cap Stock Breaks Records