Texmaco Rail RVNL order: Small-cap rail stock has bagged a major ₹129.09 crore contract from Rail Vikas Nigam Limited (RVNL), reinforcing its reputation as a leader in railway infrastructure. This order covers the design, testing, and commissioning of 2×25 KV traction overhead equipment for the Yavatmal–Digras section in Central Railway’s Nagpur Division, Maharashtra. The project is set for completion within 18 months, marking another important step in India’s ambitious rail modernization efforts.

Texmaco Rail Wins ₹129 Crore RVNL Order

Texmaco Rail RVNL order: This electrification project is part of Indian Railways’ larger drive toward sustainable, efficient transport networks. Electrifying the Yavatmal–Digras corridor with modern overhead equipment will improve energy efficiency, reduce diesel dependence, and enhance both speed and safety along this key route. Texmaco Rail’s Vice Chairman Indrajit Mookerjee commented, “This order is a testament to Texmaco’s commitment to India’s rail modernization.” Public sector clients like RVNL continue to place trust in the company’s technical capabilities and execution experience.

Also Read: 250% Jump in 6 Months! Small-Cap Stock Breaks Records with 65 Straight Upper Circuit

Contract Details Table

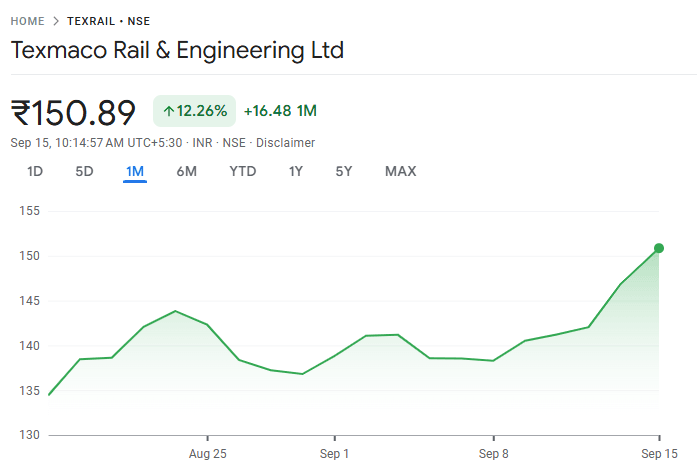

Texmaco Rail stock price today

Latest Stock Price and Current Trading Performance: Texmaco Rail’s order win. As of September 15, 2025, Texmaco Rail traded at ₹150.90 in morning session, after opening at ₹147.40 and reaching an intraday high of ₹151.80. Volume remains elevated, with over 1.6 million shares traded and a market capitalization of approximately ₹6,024 crore.

Latest Trading Data (September 15, 2025)

| Parameter | Price |

| Current Price (15th Sept 2025) | ₹150.90 |

| Opening Price | ₹147.40 |

| Intraday High | ₹151.80 |

| Intraday Low | ₹146.85 |

| Previous Close (12th Sept 2025) | ₹146.84 |

| Volume | 1.6 Million |

| Market Cap | ₹6,024 crore |

Growth Momentum and Recent Performance

Texmaco Rail’s shares have shown strong short-term momentum gaining 3% on the order news. Over the last month, the stock is up nearly 5%, and over six months, it’s seen gains of almost 14% despite broader volatility in the railway sector. The stock hit a 52-week high of ₹239.75 in December 2024 and its low of ₹119.05 in April 2025, making this rally a significant rebound for investors.

Texmaco Rail Stock Price Performance

| Period | Price Change (%) |

| 1 Day | +3.19 |

| 5 Days | +9.57 |

| 1 Month | +12.74 |

| 6 Months | +21.94 |

| 1 Year | -32.92 |

| 5 Years | +492.84 |

Expert Analysis Bullish Outlook

Analysts note Texmaco Rail’s has delivered nearly 492% gains in five years, with experts highlighting robust quarterly revenue growth (37%) and stable profit margins around 3.2%. The successful RVNL order is seen as adding visible earnings growth potential over the next few quarters

Texmaco Rail price target (2025-26)

| Target Level | Price (₹) | Analysis |

|---|---|---|

| Target 1 | 153.90 | Near-term resistance |

| Target 2 | 178.50 | Recent price action |

| Target 3 | 239.70 | 52-Week high |

| Stop Loss | 143.65 | Key technical support |

Corporate Development and Industry Position

In addition to this contract, Texmaco Rail recently completed a merger with Texmaco West Rail Limited, expected to create operational synergies and boost market position. The new order, together with recent consolidation, positions Texmaco Rail for further growth in the rapidly expanding railway electrification market.

About Texmaco Rail & Engineering

Texmaco Rail & Engineering, part of the Adventz Group, is headquartered in Kolkata and has been listed since 2011. The company is recognized for contributing to India’s railway modernization through advanced engineering solutions, aligning closely with the government’s “Green Railway” and “Make in India” initiatives.

Also Read: RVNL Share Price Target 2025, 2030, 2035, 2040, 2045 and 2050

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided in Trademint.in is for educational purposes only and we do not recommend buying or selling any stocks. This information provided is only for reference purpose so we are not responsible in case investors incur any loss based on the information. We provide timely updates about the stock market and financial products to help you make better investment choices. Always conduct your own research before making any investment decision or consult a financial advisor.