Suzlon Energy, India’s wind energy pioneer, announced on September 16, 2025, its largest order for the fiscal year: an 838 MW wind turbine project from Tata Power Renewable Energy Limited (TPREL). This deal, under the Firm and Dispatchable Renewable Energy (FDRE) programme, will see the installation of 266 advanced S144 wind turbines (each rated at 3.15 MW) across Karnataka (302 MW), Maharashtra (271 MW), and Tamil Nadu (265 MW), further strengthening India’s clean energy grid.

Girish Tanti, Vice Chairman of Suzlon Group, commented, “Our partnership with Tata Power Renewable Energy, now in its third consecutive order, exemplifies our shared commitment to India’s energy transition and the goal of 100% clean power by 2045”.

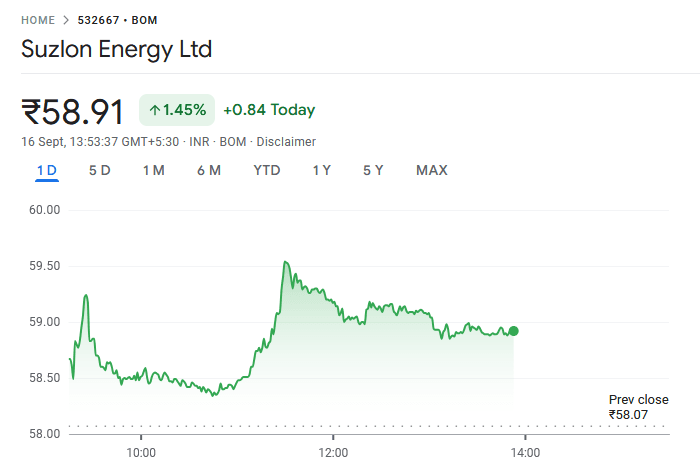

Today’s Suzlon Share Price

As of September 16, 2025, Suzlon Energy shares are trading at ₹58.90 on BSE, reflecting a gain of 1.43% or ₹0.83 compared to the previous close. The stock opened at ₹58.24 and has seen an intraday high of ₹59.64. Trading volume so far is around 6,58,36,681 shares which indicating active market participation.

Suzlon’s record 838 MW order win from Tata Power Renewable Energy, Which shows the strong leadership in India’s renewable energy sector.

Also Read: Top 3 Monopoly Stocks in India to Buy in 2025

838 MW wind order Project Scope

Turbines: 266 S144 units, each 3.15 MW capacity.

Locations: Karnataka (302 MW), Maharashtra (271 MW), Tamil Nadu (265 MW).

FDRE Initiative: Part of India’s push for “round-the-clock” renewables via SJVN and NTPC FDRE bids.

This project confirm Tata Power’s long-term aim to supply 100% by 2045 and Suzlon’s critical role as a technology provider for scalable, grid-integrated in green energy.

Suzlon Q1 FY26 Performance

Suzlon Energy delivered a strong financial performance in Q1 FY26, reporting a consolidated revenue of approximately ₹3,117 crore, marking a significant 54% year-over-year increase.

The net profit rose by 7.2% YoY to ₹324 crore, reflecting steady earnings growth amid expanding business operations. The company’s EBITDA margin saw an improvement as well, increasing by 70 basis points to 18.78%, demonstrating enhanced operational efficiency.

The wind turbine segment was a key growth driver, with revenue from this segment expanding by 67% year-over-year, underscoring Suzlon’s leadership in the wind energy market. This robust quarterly performance highlights the positive impact of strong order inflows and effective execution strategies, positioning Suzlon well to capitalize on India’s green energy transition momentum.

Also Read: Top Fundamentally Strong Stocks Under 100 in India 2025

Experts & Brokerages on Suzlon Share Price Target

Leading brokerages and experts remain bullish, with several “Buy” ratings:

Motilal Oswal: ₹80 (42% upside from current levels)

JM Financial: ₹78–81 (suggesting further growth potential).

Geojit BNP Paribas: ₹77

Morgan Stanley: ₹77

ICICI Securities: ₹76.

Also Read: Suzlon Share Price Target 2025-2050

Motilal Oswal recently commented: “Suzlon Energy is strongly positioned to benefit from expanding FDRE and hybrid renewables projects, maintaining record deliveries and healthy margins. We reaffirm our Buy rating and set a target of ₹80 per share.”

JM Financial added: “Suzlon’s strategic partnerships and innovation pipeline provide strong visibility for earnings growth. We maintain our ₹78 target and Buy rating.”

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided in Trademint.in is for educational purposes only and we do not recommend buying or selling any stocks. This information provided is only for reference purpose so we are not responsible in case investors incur any loss based on the information. We provide timely updates about the stock market and financial products to help you make better investment choices. Always conduct your own research before making any investment decision or consult a financial advisor.