IREDA bond issue 2025: Indian Renewable Energy Development Agency (IREDA) raised ₹453 crore from a highly oversubscribed perpetual bond issue at 7.70% coupon rate. Shares traded around ₹152.85 with expert target prices projecting growth. Key Q1 FY26 performance and expert brokerage targets detailed.

IREDA perpetual bonds

The Indian Renewable Energy Development Agency (IREDA) successfully raised ₹453 crore through its second issue of perpetual bonds at a coupon rate of 7.70% per annum. The bond issue witnessed strong investor interest, with bids totaling ₹1,343 crore against a base size of ₹100 crore and a green shoe option of ₹400 crore, leading to an oversubscription of 2.69 times. The funds raised will strengthen IREDA’s Tier-I capital, enabling it to accelerate financing for renewable energy projects aimed at promoting a sustainable and greener India.

Chairman and Managing Director Pradip Kumar Das say that the capital infusion will bolster IREDA’s capacity to support solar, wind, bioenergy, and emerging green technologies, playing a role in the country’s energy transition.

Also Read: Suzlon Win FY26’s Biggest Wind Energy Deal, Expert Targets Upwards of ₹80

IREDA Share Price Today

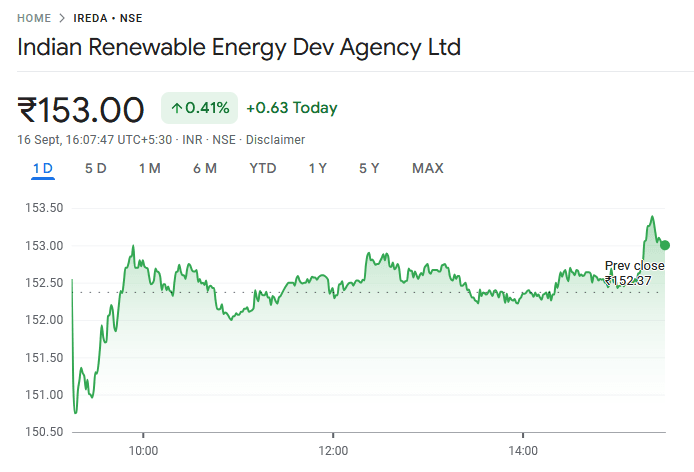

As of September 16, 2025, IREDA shares are trading around ₹152.85 on the NSE, with an intraday high of ₹153.42. The stock now trading with stable volumes and market capitalization of approximately ₹42,841 crore. Over the past month, the stock has shown 1.47% gain and has climbed over 3.5% in the last six months. The 52-week high remains ₹239.90, and the 52-week low is ₹137.01.

IREDA Trading at 37% Discount from 52-Week High

Currentely, IREDA shares are trading at ₹153 on 16th Sept 2025 on NSE, which is approximately 36.17% below its 52-week high of ₹239.90. This substantial discount presents a good opportunity for investors to buy the stock at a lower price relative to its recent peak with long-term potential in the renewable energy sector.

The current price level and volumes also indicates market stability for upside, supported by IREDA’s recent capital-raising efforts via perpetual bonds and its steady financial fundamentals

Also Read: Bajaj Finance Share Price Rockets Beyond ₹1,000

Q1 FY26 Results

In Q1 FY26, IREDA reported a strong 30% increase in total income from operations, which rose to ₹1,960 crore from ₹1,511 crore in the same period last year.

Operating profit surged by 49% year-on-year to ₹677 crore. The loan book expanded by 26% to ₹79,941 crore, while loan disbursements also increased 31% year-on-year but the consolidated net profit declined by 36% to ₹247 crore due to higher provisions and asset quality challenges, with net NPA rising to 2.06% from 1.35% in the previous quarter.

IREDA Share Price Target

Here is the updated Expert and Brokerage Target Price section with specific firm names and their target prices:

| Brokerage Firms / Expert | Target Price (₹) |

| ET Now Market Experts | 425.00 |

| ICICI Direct | 173.00 |

| Average Target Price | 254.18 |

Also Read: IREDA Share Price Target 2025-2050

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided in Trademint.in is for educational purposes only and we do not recommend buying or selling any stocks. This information provided is only for reference purpose so we are not responsible in case investors incur any loss based on the information. We provide timely updates about the stock market and financial products to help you make better investment choices. Always conduct your own research before making any investment decision or consult a financial advisor.