Anil Ambani stocks are making a strong comeback, after long years of underperformance two stocks are now showing strong bullish signals on the charts. Both stocks have crossed key resistance levels and moved above their 200-day moving averages with strong volume. If you’re looking for stocks with solid breakout potential in 2025, these two of Anil Ambani’s masterpieces could be worth adding to your watchlist!

Table of Contents

Anil Ambani 2 Stocks to Add to Your Watchlist in 2025

Two linked companies to businessman Anil Ambani stocks, have seen dramatic ups and downs in the past few years especially after the 2019 lockdown, but in 2023, all things started to change, and now in 2025 both these stocks are getting attention again because of strong growth achived with deciplened masterplan and now chart near to positive breakout.

If you’re looking for the best mid-cap stocks with a solid comeback, these two Anil Ambani group stocks is now good options to keep an eye on in your watchlist.

Anil Ambani stocks to watch in 2025

In the past, Anil Ambani’s both two stocks were approximately down by 90-95% they faced big price falls and were very unstable. But now, compared to this low today the both stocks give multibagger returns in the last 5 years, surprisingly first one gives 1679% return,s and the second shows above 2000% returns with a strong comeback, which was never expected.

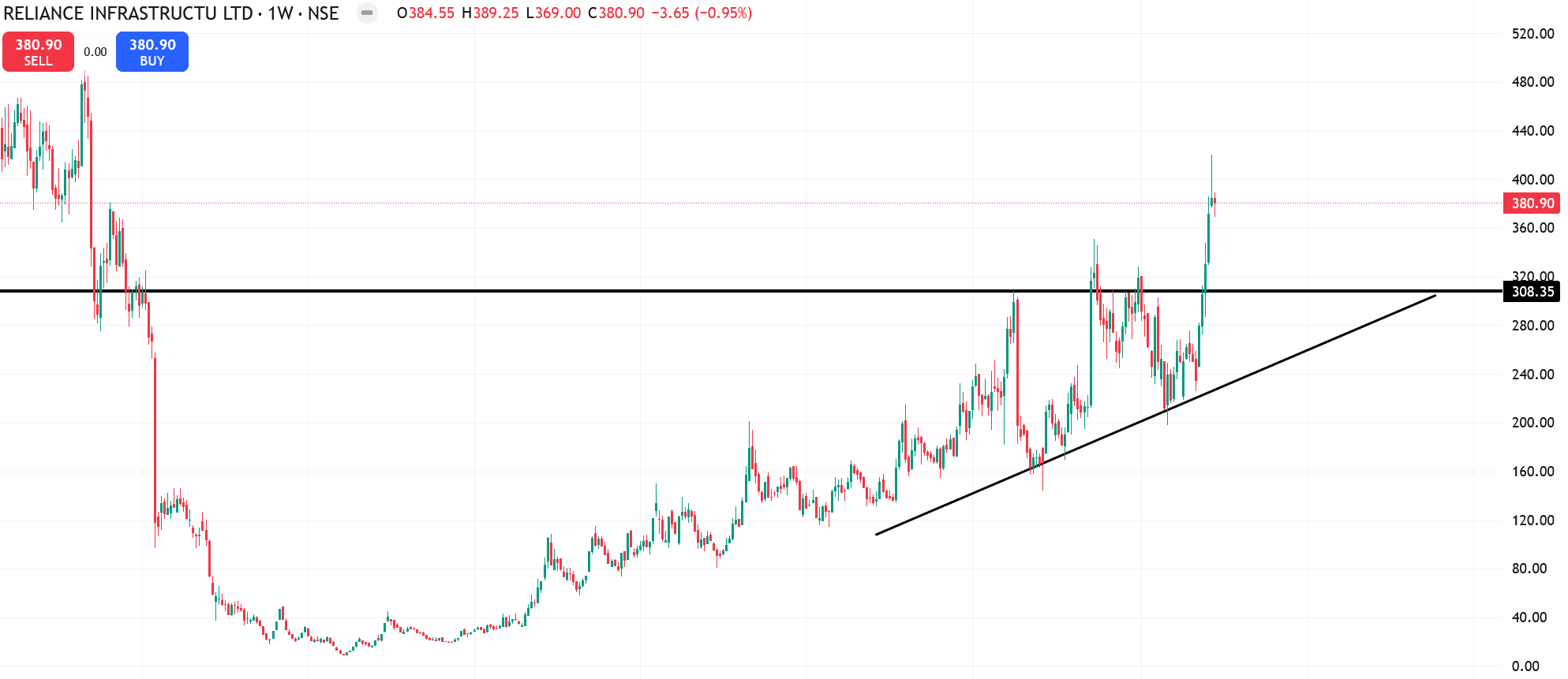

Stock 1: Reliance Infrastructure Share

Reliance Infra sharply dropped to below ₹9 during the COVID-19 crash. But now, it’s slowly making an unbelievable comeback.

Why Reliance Infra looks strong

- A breakout above major resistance on the daily timeframe shows a strong sign of trend reversal.

- Trading above 200-day moving average, which indicates a long-term bullish trend.

- RSI above 60 shows movement.

- Increased trading volume

Reliance Infrastructure Technical Analysis

The stock is forming a bullish chart pattern, an ascending triangle with a strong breakout. In technical analysis, this is a bullish chart pattern. But remember it’s trading near old resistance level from 2019, but above the 200-day moving average. These show that the stock could move higher in the coming days.

Reliance Infra Share Price Performance on NSE

| Timeline | Growth (%) |

| Last 1 Month | +36.28% |

| Last 3 Months | +73.63% |

| Last 1 Year | +81.54% |

| Last 3 Year | +299.27% |

| Last 5 Year | +1679.91% |

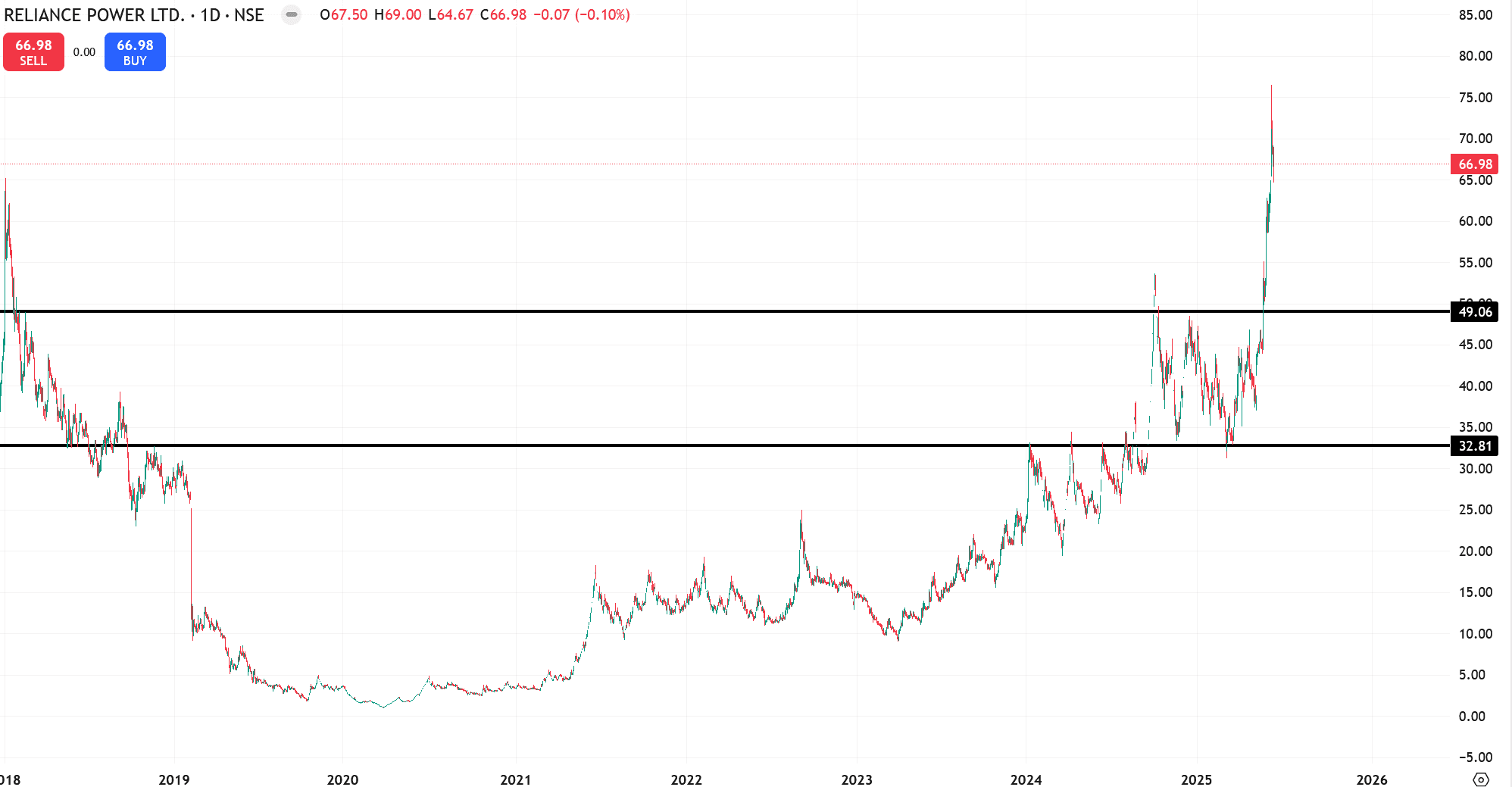

Stock 2: Reliance Power Share

Reliance Power was one of the underperforming stocks, everyone avoided because this stock never came back after listing IPO and also they faced the worst scenario in lockdown. But since April 2023, the stock has rapidly up by nearly 6 times, indicating strong investor interest.

Bullish Technicals in Reliance Power

- Breakout from a rectangle pattern (Darvas Box Pattern) in the daily timeframe.

- Price holding above 200-day moving average.

- Strong RSI above 16 of the 14-period RSI.

- Strong volume surge during breakout.

Also Read: Reliance Power Share Price Target 2025-2050

Reliance Power Technical Analysis

After consolidating in a small range of rectangles, Reliance Power gets a breakout. Also, the bullish indicators across daily, weekly, and monthly charts are suggesting a bullish move is in the short term as well as the long term.

Reliance Power Share Price Performance on NSE

| Timeline | Growth (%) |

| Last 1 Month | +3.65% |

| Last 3 Months | +102.85% |

| Last 1 Year | +117.26% |

| Last 3 Year | +455.85% |

| Last 5 Year | +2292.15% |

Final Words

Both Anil Ambani stocks, Reliance Infrastructure and Reliance Power stocks have faced huge corrections in the past, but are now both recovering, with solid technical. Stocks formed panic bottoms in single digits to regain strength.

As RSI momentum increases with showing volumes surge, and key resistance levels are broken, these Anil Ambani stocks could be gearing up for a bullish trend.

Also Read: Reliance Jio IPO: Asia’s Richest Man Mukesh Ambani is Gearing up to Launch India’s Biggest Ever IPO

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided in Trademint.in is for educational purposes only and we do not recommend buying or selling any stocks. This information provided is only for reference purpose so we are not responsible in case investors incur any loss based on the information. We provide timely updates about the stock market and financial products to help you make better investment choices. Always conduct your own research before making any investment decision or consult a financial advisor.