Poonawalla Fincorp shares jump up to 12.09% in intraday session on September 18, 2025, touching a fresh 52-week high of ₹513.35 on the NSE after its board approved preferential allotment of 3.31 crore equity shares to its promoter, Rising Sun Holdings Private Limited, at an issue price of ₹452.51 per share.

Poonawalla Fincorp Shares Rally on Promoter Stake

Poonawalla Fincorp’s board has recently approved the preferential allotment of 3,31,48,102 fully paid-up equity shares to its promoter entity, Rising Sun Holdings Private Limited. This significant issue was carried out at a price of ₹452.51 per share, leading to a capital infusion of approximately ₹1,499.98 crore into the company. With this allotment, the issued, subscribed, and paid-up equity share capital of Poonawalla Fincorp has risen from ₹155.84 crore to ₹162.47 crore, while the total number of shares outstanding has increased from 77.92 crore to 81.24 crore.

The newly issued shares are fully pari-passu with the existing equity shares, meaning they have identical rights for voting and dividends equal treatment for both new and old shareholders. By completing this the promoter holding in Poonawalla Fincorp has further strength with long term commitment.

This move improve Poonawalla Fincorp’s capital base and promoter’s positive assessment of the company’s value and future potential, contributing a positive sentiment in investors in the market.

Also Read: Top 3 Monopoly Stocks in India to Buy in 2025

Latest Share Price Details

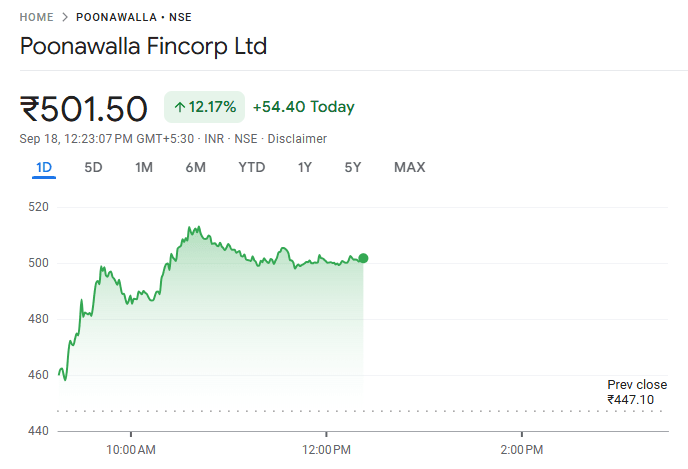

Poonawalla Fincorp opened today at ₹453.00 and surged as high as ₹513.35 during current session. Now the latest price trading around ₹499.05 on 12:00 PM. The average traded price stood at ₹494.25, while the company’s market capitalization crossed ₹39,944 crore. YTD, the stock has jump 59%, and stock made new 52-Week High.

Poonawalla Fincorp Shareholding pattern

As of September 2025, Poonawalla Company shareholding pattern is led by its promoters, who hold a majority stake, ensuring strong promoter backing and stability for the company. Foreign and domestic institutional investors also own a significant portion, with the remainder held by retail investors and others.

| Category | Percentage (%) |

| Promoters | 62.46 |

| Foreign Institutional Investors (FII) | 10.76 |

| Domestic Institutional Investors (DII) | 12.27 |

| Retail & Others | 14.52 |

Also Read: 1,013% rally in 5 years! Small Cap Stock Jumps 19% Before NSE Debut

Poonawalla Fincorp share Price Performance

NSE: POONAWALLA (Source Google Finance)

| Period | Returns (%) |

| Today (18th Sept 2025, 12:00 PM) | 501.20 (+12.11%) |

| 1 Month | 7.12% |

| 6 Months | 63.66% |

| YTD | 59.50% |

| 1 Years | 26.21% |

| 5 Years | 1,234.13% |

Also Read: RVNL Secures Massive Orders, RVNL Share price Jump 13% in 9 Straight Sessions

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided in Trademint.in is for educational purposes only and we do not recommend buying or selling any stocks. This information provided is only for reference purpose so we are not responsible in case investors incur any loss based on the information. We provide timely updates about the stock market and financial products to help you make better investment choices. Always conduct your own research before making any investment decision or consult a financial advisor.