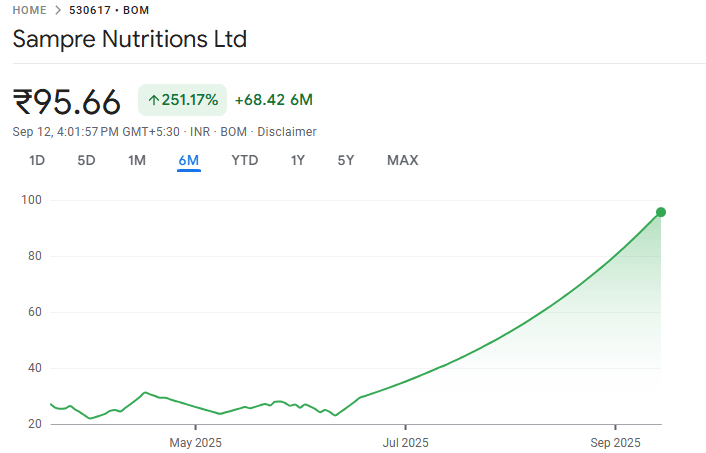

Sampre Nutritions, a small-cap stock, has emerged as a formidable multibagger company in 2025. The shares jump over 250% in the past six months, hitting the upper circuit continuously for an incredible 67 days in a row on the Indian stock market. This rally has placed Sampre Nutritions in spotlight for stock market investors looking for high-growth small-cap opportunities.

Sampre Nutritions upper circuit: Small-cap multibagger stock capture investors’ attention on Tuesday, 16 September 2025, after its shares hit the upper circuit for 67 consecutive trading sessions.

Small-Cap Stock Approved Warrant Conversion

The company’s board approved the allotment of 5.5 lakh equity shares on the conversion of share warrants. The exercise price for conversion was ₹45.375 per warrant, resulting in a capital inflow exceeding ₹2.49 crore. Promoter Brahma Gurbani converted 5 lakh warrants, while public shareholder Vishal Ratan Gurbani converted 50,000. Consequently, the paid-up equity capital increased from ₹21.01 crore to ₹21.55 crore, with the total shares rising from 2.10 crore to 2.15 crore equity shares of ₹10 each.

Also Read: Top Fundamentally Strong Stocks Under 100 in India 2025

Sampre Nutritions Share Price Performance

The stock closed at ₹99.52 on 16th September 2025, marking a 2% gain from the prior session. The shares have gained approximately 250% in six months and more than 600% over five years, highlighting its exceptional growth. The market capitalization as of mid-September 2025 at ₹200.95 crore.

Stock Price Market data as on 15th September 2025

| Latest Closing Price (16th September 2025) | ₹99.52 |

| 52-Week High | ₹101.17 |

| 52-Week Low | ₹20.90 |

| Market Capitalization | ₹204.96 crore |

| YTD Gain (2025) | 55.12% |

| 6-Month Gain | 258% |

| 1 Month Gain | 48.40% |

| 5-Year Return | 767.29% |

Market data indicates strong momentum for Sampre Nutritions, with rising delivery volumes and gains above key moving averages. The stock has outperformed the broader Sensex and FMCG sector benchmarks, supported by a recent manufacturing agreement valued at ₹15 crore, enhancing its nutraceutical and food product business. While the stock has volatility typical of small caps, the consistent upper circuit limits and warrant conversion success signal strong underlying growth and investor interest.

Also Read: Bajaj Finance Share Price Rockets Beyond 1,000 After Bonus and Stock Split

Sampre Nutritions Stock Holding Details

As of September 2025, the promoter holding in Sampre Nutritions stands at approximately 12.11% of the total equity, reflecting a slight decrease from about 14.16% earlier in the year. The major promoter shareholders include Brahma Gurbani and family members, collectively holding the bulk of promoter equity.

Share Holding Pattern Table:

| Category | Holding (%) |

| Promoters and Promoter Group | 12.11% |

| Foreign Institutional Investors (FII) | 0.00% |

| Domestic Institutional Investors (DII) | 0.00% |

| Mutual Funds | 0.00% |

| Retail Investors | 87.89% |

| Others | 0.00% |

The stock’s consistent upper circuit limits for over two months reflect strong buying interest, while the successful warrant conversion reinforces confidence in company growth and promoter commitment. With a solid market cap rising alongside surging share prices, Sampre Nutritions continues to position itself as a small-cap favorite for traders and investors.

Also Read: Top 5 Sugar Stocks in India, Growth & Dividend Picks

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided in Trademint.in is for educational purposes only and we do not recommend buying or selling any stocks. This information provided is only for reference purpose so we are not responsible in case investors incur any loss based on the information. We provide timely updates about the stock market and financial products to help you make better investment choices. Always conduct your own research before making any investment decision or consult a financial advisor.